Team News Riveting

Raipur, April 14

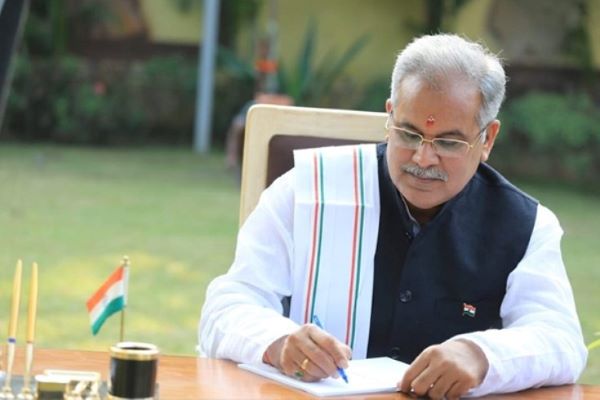

Chhattisgarh Chief Minister Bhupesh Baghel has urged Centre to extend the compensation period of the Goods and Services Tax (GST) by 10 years.

In a letter penned to the Prime Minister, Narendra Modi, Baghel urged to continue the present system of GST compensation for the next 10 years. He opined that the Central Government should make an alternative permanent arrangement for compensation of revenue to the producing states at the earliest.

Asserting that the discontinuation of GST compensation grant would be a huge revenue loss for producing states like Chhattisgarh, Baghel said, “Being a manufacturing state, our contribution in the development of the country’s economy is much more than those states which have been benefited in the GST tax system due to higher consumption of goods and services. If the GST compensation is not continued beyond June 2022, then Chhattisgarh is likely to face a revenue loss of nearly Rs 5 thousand crore in the upcoming year. Similarly, many other states will also face revenue shortfall in the coming year. Due to this, it would be difficult to arrange for a shortfall in funds for the ongoing public welfare and development works in the state.”

Chhattisgarh Chief Minister referred to the pre-budget consultation meetings for fiscal 2022-23 chaired by the Union Finance Minister with the Chief Ministers and Finance Ministers, which was held in New Delhi in December 2021. He said many states including Chhattisgarh requested to extend the GST compensation grant for the states. The states expect a positive decision from the central government in this regard, Baghel said.

After the implementation of the GST tax system, the autonomy of states in shaping tax policies have become very limited and there is not much revenue-related potential in the tax revenue other than commercial tax, he said, adding that although, every effort is being made by them for revenue generation. The present compensation grant system should be continued for the next 10 years to recover from the adverse impact of Covid-19 on the economy of states and till the time actual benefits of the GST tax system are realized.

The Chief Minister has expressed hope that the Prime Minister will agree with the concerns raised by the states and will act in the spirit of cooperative federalism to resolve the important issue involving the interests of all states.