Team News Riveting

Raipur, January 1

Chhattisgarh witnessed a marginal one per cent year-on-year (y-o-y) growth in the GST collection during the April-December 2023 period compared to corresponding period of last year.

According to the data released by the Ministry of Finance today, Chhattisgarh collected Rs 2613 crore compared to Rs 2585 core collected during April-December 2022. The y-o-y growth was just one per cent.

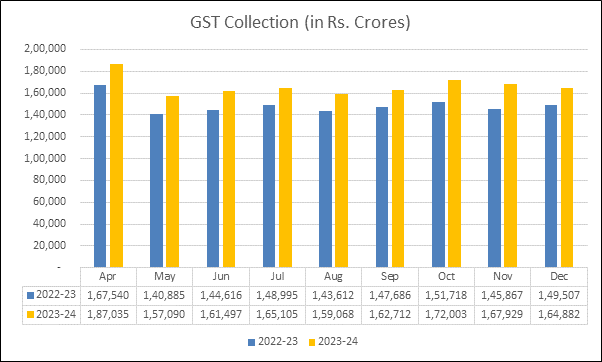

However, the gross GST collection across the country witnessed a robust 12 per cent y-o-y growth, reaching Rs 14.97 lakh crore, as against Rs 13.40 lakh crore collected in the same period of the previous year (April-December 2022). The average monthly gross GST collection of Rs 1.66 lakh crore in the first 9-month period this year represents a 12 per cent increase compared to the Rs 1.49 lakh crore average recorded in the corresponding period of FY23.

The gross GST revenue collected in the month of December, 2023 is Rs 1,64,882 crore out of which CGST is Rs 30,443 crore, SGST is Rs 37,935 crore, IGST is Rs 84,255 crore (including Rs 41,534 crore collected on import of goods) and cess is Rs 12,249 crore (including Rs 1,079 crore collected on import of goods). Notably, this marks the seventh month so far this year with collections exceeding Rs 1.60 lakh crore.

The government has settled Rs 40,057 crore to CGST and Rs 33,652 crore to SGST from IGST. The total revenue of Centre and the States in the month of December, 2023 after regular settlement is Rs 70,501 crore for CGST and Rs 71,587 crore for the SGST.

The revenues for the month of December, 2023 are 10.3 per cent higher than the GST revenues in the same month last year. During the month, the revenues from domestic transactions (including import of services) are 13 per cent higher than the revenues from these sources during the same month last year.

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of December 2023 as compared to December 2022. Table-2 shows the state-wise figures of post settlement GST revenue of each State till the month of December 2023.

Chart: Trends in GST Collection

Table -1: State-wise growth of GST Revenues during December, 2023

| State/UT | Dec-22 | Dec-23 | Growth (%) |

| Jammu and Kashmir | 410 | 492 | 20% |

| Himachal Pradesh | 708 | 745 | 5% |

| Punjab | 1,734 | 1,875 | 8% |

| Chandigarh | 218 | 281 | 29% |

| Uttarakhand | 1,253 | 1,470 | 17% |

| Haryana | 6,678 | 8,130 | 22% |

| Delhi | 4,401 | 5,121 | 16% |

| Rajasthan | 3,789 | 3,828 | 1% |

| Uttar Pradesh | 7,178 | 8,011 | 12% |

| Bihar | 1,309 | 1,487 | 14% |

| Sikkim | 290 | 254 | -13% |

| Arunachal Pradesh | 67 | 97 | 44% |

| Nagaland | 44 | 46 | 4% |

| Manipur | 46 | 50 | 9% |

| Mizoram | 23 | 27 | 18% |

| Tripura | 78 | 79 | 2% |

| Meghalaya | 171 | 171 | 0% |

| Assam | 1,150 | 1,303 | 13% |

| West Bengal | 4,583 | 5,019 | 10% |

| Jharkhand | 2,536 | 2,632 | 4% |

| Odisha | 3,854 | 4,351 | 13% |

| Chhattisgarh | 2,585 | 2,613 | 1% |

| Madhya Pradesh | 3,079 | 3,423 | 11% |

| Gujarat | 9,238 | 9,874 | 7% |

| Dadra and Nagar Haveli and Daman & Diu | 318 | 333 | 5% |

| Maharashtra | 23,598 | 26,814 | 14% |

| Karnataka | 10,061 | 11,759 | 17% |

| Goa | 460 | 553 | 20% |

| Lakshadweep | 1 | 4 | 310% |

| Kerala | 2,185 | 2,458 | 12% |

| Tamil Nadu | 8,324 | 9,888 | 19% |

| Puducherry | 192 | 232 | 21% |

| Andaman and Nicobar Islands | 21 | 28 | 35% |

| Telangana | 4,178 | 4,753 | 14% |

| Andhra Pradesh | 3,182 | 3,545 | 11% |

| Ladakh | 26 | 58 | 127% |

| Other Territory | 249 | 227 | -9% |

| Center Jurisdiction | 179 | 243 | 36% |

| Grand Total | 1,08,394 | 1,22,270 | 13% |

Table-2: SGST & SGST portion of IGST settled to States/UTs

April-December (Rs. in crore)

| Pre-Settlement SGST | Post-Settlement SGST[2] | |||||

| State/UT | 2022-23 | 2023-24 | Growth | 2022-23 | 2023-24 | Growth |

| Jammu and Kashmir | 1,699 | 2,188 | 29% | 5,442 | 6,021 | 11% |

| Himachal Pradesh | 1,731 | 1,929 | 11% | 4,205 | 4,160 | -1% |

| Punjab | 5,719 | 6,280 | 10% | 14,371 | 16,382 | 14% |

| Chandigarh | 451 | 495 | 10% | 1,582 | 1,708 | 8% |

| Uttarakhand | 3,568 | 4,046 | 13% | 5,758 | 6,288 | 9% |

| Haryana | 13,424 | 14,992 | 12% | 23,134 | 25,733 | 11% |

| Delhi | 10,167 | 11,544 | 14% | 21,426 | 23,611 | 10% |

| Rajasthan | 11,483 | 12,732 | 11% | 25,903 | 28,794 | 11% |

| Uttar Pradesh | 20,098 | 24,164 | 20% | 49,384 | 55,656 | 13% |

| Bihar | 5,307 | 6,067 | 14% | 17,360 | 19,157 | 10% |

| Sikkim | 221 | 341 | 54% | 623 | 738 | 18% |

| Arunachal Pradesh | 344 | 464 | 35% | 1,176 | 1,418 | 21% |

| Nagaland | 158 | 226 | 43% | 716 | 781 | 9% |

| Manipur | 216 | 254 | 18% | 1,046 | 813 | -22% |

| Mizoram | 130 | 197 | 51% | 623 | 707 | 14% |

| Tripura | 311 | 375 | 21% | 1,074 | 1,166 | 9% |

| Meghalaya | 339 | 438 | 29% | 1,087 | 1,244 | 14% |

| Assam | 3,785 | 4,346 | 15% | 9,280 | 10,727 | 16% |

| West Bengal | 15,959 | 17,428 | 9% | 29,170 | 31,300 | 7% |

| Jharkhand | 5,562 | 6,545 | 18% | 8,237 | 9,148 | 11% |

| Odisha | 10,313 | 11,903 | 15% | 14,046 | 18,093 | 29% |

| Chhattisgarh | 5,426 | 6,004 | 11% | 8,370 | 9,937 | 19% |

| Madhya Pradesh | 7,890 | 9,606 | 22% | 20,834 | 24,026 | 15% |

| Gujarat | 27,820 | 31,028 | 12% | 42,354 | 46,624 | 10% |

| Dadra and Nagar Haveli and Daman and Diu | 479 | 481 | 0% | 889 | 804 | -10% |

| Maharashtra | 63,169 | 74,589 | 18% | 95,981 | 1,08,887 | 13% |

| Karnataka | 25,976 | 30,070 | 16% | 48,642 | 54,881 | 13% |

| Goa | 1,435 | 1,685 | 17% | 2,606 | 2,951 | 13% |

| Lakshadweep | 7 | 17 | 153% | 22 | 72 | 222% |

| Kerala | 9,011 | 10,293 | 14% | 21,953 | 23,045 | 5% |

| Tamil Nadu | 26,657 | 30,329 | 14% | 43,332 | 47,960 | 11% |

| Puducherry | 344 | 371 | 8% | 876 | 1,037 | 18% |

| Andaman and Nicobar Islands | 133 | 155 | 16% | 365 | 388 | 7% |

| Telangana | 12,287 | 14,579 | 19% | 27,964 | 29,889 | 7% |

| Andhra Pradesh | 9,298 | 10,407 | 12% | 21,137 | 23,481 | 11% |

| Ladakh | 123 | 186 | 51% | 420 | 523 | 25% |

| Other Territory | 135 | 182 | 35% | 420 | 903 | 115% |

| Grand Total | 3,01,175 | 3,46,938 | 15% | 5,71,807 | 6,39,052 | 12% |