R Krishna Das

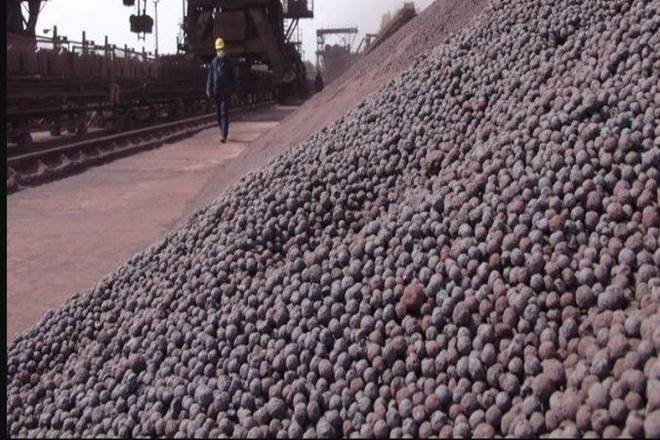

The export of pellets has put steel manufacturers and exporters at loggerheads.

While the steel manufacturers cite commodity scarcity and demanding imposition of 30% export duty on iron ore pellets to avoid shipping, market analysts feel there is no such crises of raw material for the steel maker.

The issue of whether pellets should be levied export duty came up for in-depth analysis after Chhattisgarh Sponge Iron Manufacturers’ Association wrote to Prime Minister Narendra Modi.

“We request you to kindly consider our proposal for levy of 30% export duty on iron ore pellets and ban all exports above 63% Fe to safeguard the domestic steel producers especially the secondary steel producers having no captive iron ore mine,” the association said.

The exporters contest and foresee a foul play by miners winning iron ore mines in recent e-auction. It is obvious that if duty is levied on Iron Ore Pellets, the export of pellets will completely stop resulting in huge surplus of iron ore pellet in the country due to poor demand in the domestic market.

This will lead to reduction in prices of Pellet and hence reduction in prices of Iron Ore Lumps and Iron Ore fines. This reduction in prices will give benefit to the miners who have taken mines in the e-auction as they will end up paying fewer premiums that is linked to IBM Average monthly sales price.

Any decrease in prices of iron ore in the respective states will obviously lead to reduction in prices as declared by IBM, because IBM takes the average of sales price of the non-captive miners in the state to deduce the monthly average sales price of iron ore. Final outcome will be lower premium being paid by such miners to the Government and hence huge loss of revenue to the ex-chequer.

The off-take account however gainsays the ground of commodity scarcity. In 2019-20, iron ore production by state-run NMDC reserved 5.4 million tonnes (MT) of iron ore for the Chhattisgarh based industries; the off-take was just 2.02 MT —not even half. Analysts say Sponge iron producers in Chhattisgarh have Iron Ore in abundance in the state. They reduce the off-take from NMDC if NMDC increases the price and start taking pellet.

The off-take from NMDC increases if it reduces the price. “This is just to create an unhealthy pricing competition between pellet producers and commercial iron ore producer which is NMDC in Chhattisgarh,” a producer puts it succinctly.

Industry experts say imposition of export duty on Pellets will lead to stoppage of export resulting in bankruptcy and shut down. Huge investments will go bad accompanied by increase in Bank NPAs, unemployment and loss of revenue for the ex-chequer.

The survival of Pellet Industry due fluctuating domestic demand is always under question and Exports are the only option left with the Pellet Producers. Besides Exports brings in valuable foreign exchange for the country.